Hedge Funds: What Are They and Their Types

- 24 lis 2024

- 4 minut(y) czytania

Jan Cielicki

Hedge funds are a unique kind of investment for investors who look for innovative ways to generate money. In contrast to traditional funds that invest in pretty obvious assets such as stocks or bonds, hedge funds can invest in nearly anything, including currencies, commodities, and other more complex financial instruments. Since joining them can be risky and expensive, they are typically only available to wealthy individuals or large corporations.

Hedge funds are unique in that they can generate profits even when the whole market is struggling. They adopt various strategies to make money in both good and bad times, whereas regular, more standard funds may lose money when stock prices go down.

Features of hedge funds:

Investment Flexibility:

A vast portfolio of assets, which includes but is not limited to stocks, bonds, commodities, currencies, and derivatives, is available for investment by hedge funds. Thanks to this flexibility, they can employ a variety of tactics to optimize profits.

Active Management

Experienced investment professionals actively manage hedge funds, keeping a close eye on market conditions and modifying plans as necessary.

Strict Regulation

Hedge funds can adopt more sophisticated investment strategies because they are subject to fewer regulatory restrictions than mutual funds. Nevertheless, depending on the nation, they are still governed by certain laws.

Expensive Minimum Investment

The majority of hedge funds are only available to wealthy individuals and institutional investors due to their high initial investment requirements, which typically range from hundreds of thousands to millions of dollars.

Lock-Up Periods

Investors cannot take their money out of many hedge funds during lock-up periods. This supports the fund's long-term investments and stable capital base.

Risk Management

To guard against possible losses and preserve investor capital, hedge funds frequently use sophisticated risk management strategies, such as short selling.

The Market for Hedge Funds Development

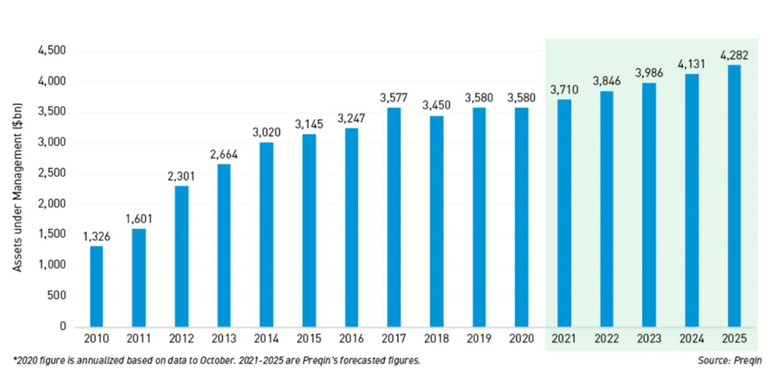

The hedge fund business has experienced considerable growth in last years, with the total assets under management (in short AUM) in hedge funds currently surpassing 4 trillion dollars globally. Due to the possibility of better returns than traditional funds, a growing number of major organizations, pension funds, and rich individuals are investing in hedge funds. This quick expansion shows that hedge funds are playing a larger role in the world financial sector.

Some of the most popular hedge fund kinds and their strategies include:

1. Hedge funds that are quantitative:

Quantitative hedge funds sometimes known as "quant funds" make investment decisions using complex mathematics and computer algorithms. These funds use data and computer algorithms, rather than human decisions and feelings, to identify market trends. One of the most popular quant funds is Renaissance Medallion, the flagship fund of Jim Simons' Renaissance Technologies, which has generated billions of dollars in returns. This fund’s AUM is approximately 106 billion dollars. The fund is frequently closed to new participants due to its size and profitability. With regards to yearly percentage returns, Renaissance Technologies is the best hedge found in history. To illustrate how successful the found is: if you had invested in it100 dollars in 1988, you would have 398.7 million dollars today.

2. Event Driven Hedge Funds

Event driven funds focus on significant occurrences, such as bankruptcies or mergers. Their main goal is to make money of fluctuations in stock prices such events prompt. For instance, these funds attempt to profit from the frequent changes in stock values that occur when two businesses join. Paul Singer's Elliott Management is a well-known example of this kind of fund. Elliott frequently makes investments in businesses going through significant transitions, including mergers or re-organizations. It manages more than 55 billion dollars, which makes it one of the biggest event driven funds.

3. Global Macro Hedge Funds

Global macro funds make investments based on major global economic trends. These funds examine such factors as inflation, interest rates, and political shifts in different countries. Ray Dalio's Bridgewater Associates is a prominent example of a global macro fund. It manages more than 150 billion dollars globally. The fund makes investments in a range of assets, including bonds, commodities, and currencies, in an effort to take advantage of shifts in the world economy.

4. Long/Short Equity Hedge Funds

These funds take long positions, which means they make investments in stocks they believe will increase in value, and short positions, they believe equities will decline. As a result, they are able to make money in both rising and declining market. Bill Ackman's Pershing Square Capital Management one of such long/short equity funds. It is well known for is high profile returns on businesses like Chipotle and Herbalife. Around 11 billion dollars is managed by it.

5. Credit Hedge Funds

Credit hedge funds concentrate on debt investments, such as loans or company bonds. By purchasing the debt of faltering businesses and then selling it when the firm improves, they hope to make money off shifts in interest rates. Managing around 24 billion dollars, Canyon Partners frequently makes investments in financially troubled businesses in the hopes of making money if the businesses turn around in the way of profit.

Conclusion

Even under challenging market conditions, with the help of hedge funds, investors can use a variety of tactics to try to make money. With almost 4 trillion dollars in assets under management, hedge fund industry has grown rapidly, which suggests considerable significance of this type of funds.

Every kind of hedge fund operates differently: some, like Renaissance Technologies, are based on computer data, while others, such as Bridgewater Associates, focus on identifying global patterns. Due to the risks involved, these funds are only available to major institutions or rich individuals. Hedge funds are a vital component of the financial industry because of their features, which include investment flexibility, active management, and robust methodology.

Sources:

1)"The Biggest Hedge Funds in the World." Business Insider, www.businessinsider.com/largest-hedge-funds-by-aum-2024.

2)"Bridgewater Associates: The World's Largest Hedge Fund." Forbes, www.forbes.com/sites/nathanvardi/2023/03/20/ray-dalio-and-the-worlds-largest-hedge-fund/.

3)"Hedge Fund Assets Reach Record Levels." Bloomberg, www.bloomberg.com/news/articles/2024-01-15/hedge-fund-assets-surge-to-record-4-trillion.

4)"Hedge Funds." Investopedia, www.investopedia.com/terms/h/hedgefund.asp."Inside Bill Ackman's Pershing Square." CNBC, www.cnbc.com/2022/05/03/inside-bill-ackmans-hedge-fund-pershing-square.html.

5) "Paul Singer’s Elliott Management: Event-Driven Success." New York Times, www.nytimes.com/2022/12/21/business/paul-singer-elliott-management.html.

6)"Renaissance Technologies – Medallion Fund." Financial Times, www.ft.com/content/aa4b3b4e-1234-11eb-9f80-57baa707c0a0.

7) Smigel, L. (2023) “107 + best hedge funds. Statistics and facts.”

8) "Top 5 Hedge Fund Strategies." The Balance, www.thebalance.com/top-hedge-fund-strategies-2894714.

9)"What Are Hedge Funds?" U.S. Securities and Exchange Commission (SEC), www.sec.gov/reportspubs/investor-publications/investorpubshedefundshtm.html.

Komentarze